Which one of the following is an example of systematic risk? A. investors panic causing security prices around the globe to fall precipitously. Which of the following statements concerning risk are correct? I. Nondiversifiable risk is measured by beta.Non-diversifiable risk is the risk common to the entire class of assets or liabilities. The value of investment decline over the period due to the changes in the economic conditions of the country or any changes which affect the major portion of the market.Diversifiable risk, also known as unsystematic risk, is defined as firm-specific risk and hence impacts the price of that individual stock rather than affecting the whole industry or sector in which the firm operates. A simple diversifiable risk example would be a labor...Which of the following is an example of nondiversifiable risk? A) Risk resulting from foreign expropriation of U.S. Steel property. 25) When constructing a portfolio, it is a good idea to put all your eggs in one basket, then watch the basket closely.Non-diversifable risk is the inherent risk that affects the overall market. *A company can eliminate much of the diversifiable risk by doing just that... diversifying. This means that the more diverse the securities in your portfolio are, the less diversifiable risk you will be...

Total Risk, Non-Diversifiable Risk and Diversifiable Risk

A non diversificable risk is a risk that cannot be eliminated by diversifying a portfolio. It is dependent on the market conditions. A diversificable risk is a risk that can be eliminated by d. Incognit-oh-no… Log in or create an account to stay incognito. Or, you can just switch to normal browsing....is an example of a non diversifiable risk? a. a key employee suddenly resigns and accepts employment with a key competitor b. a well-respected chairman of the several jobs e. a well-respected president of a firm suddenly resigns The rate of interest is 2.95%.Non-systematic risk is a risk common to just an investment or a company. If the chairman of the Federal Reserve Bank suddenly resigns, it would affect a wide range of investments in the market and not just a company, which is an example of a non-diversifiable risk.Which one of the following is an example of unsystematic risk? National decrease in consumer spending on entertainment. II. The risk premium increases as diversifiable risk increases. III. Systematic risk is another name for non-diversifiable risk.

Diversifiable Risk (Definition, Examples) | What is...

Non-diversifiable risk can be referred to a risk which is common to a whole class of assets or liabilities. The investment value might decline over a specific period of time only due to economic changes or other events which affect large sections of the market.An example of a diversifiable risk is the risk that a particular company will lose market share. It will not have any impact on other companies in a diversified portfolio, so the only loss to an investor holding shares in the company will be the decline in that one share.Select one: a. a well-respected chairman of the Federal Reserve suddenly resigns b. a key employee suddenly resigns and accepts employment with a key competitor c. a poorly managed firm suddenly goes out of business due to lack of sales d. a well-managed firm reduces its work force and...Which of the following types of risks best meets the requirements for being insurable by private insurers? One branch of government insurance programs has a number of distinguishing characteristics. These programs are compulsory, they are financed by mandatory contributions rather...13. Which of the following statements concerning nondiversifiable risk are correct? a. the inflation rate increases unexpectedly b. the federal government lowers income taxes c. an oil tanker runs aground and spills its cargo d. interest rates decline by one-half of one percent e. the GDP rises by 2...

Meaning and definition of non-diversifiable risk

Non-diversifiable risk can also be referred to a risk which is not unusual to a complete magnificence of belongings or liabilities. The investment price may decline over a explicit duration of time simplest due to economic changes or different occasions which impact massive sections of the marketplace. However, diversification and asset allocation can give protection in opposition to non-diversifiable risk as other sections of the marketplace have a tendency to underperform at other instances. Non-diversifiable risk can be referred as market risk or systematic risk.

Putting it simple, risk of an investment asset (real estate, bond, stock/percentage, and many others.) which cannot be mitigated or eliminated by way of including that asset to a various funding portfolio can also be delineated as non-diversifiable risks. Moreover, this is the risk you are uncovered to in an individual funding. This risk sort is keen on almost every funding, i.e. uncertainty of marketplace moving up or down and the specific movement of the funding.

Understanding non-diversifiable risk

Being unavoidable and non-compensating for exposure to such risks, non-diversifiable risk can be taken as the vital phase of an asset's risk because of marketplace factors affecting all companies. The primary reasons for this risk sort come with inflation, conflict, political occasions, and world incidents. Moreover, it can't be purged via diversification.

Factors accountable for non-diversifiable risk

Non-diversifiable risk is an outcome of elements influencing the entire marketplace like changes in investment coverage, overseas investment policy, alterations in taxation clauses, altering of socio-economic parameters, international security threats and measures, and so on. the non-diversifiable risk is no longer beneath the traders' keep an eye on and is also difficult to be mitigated to a massive extent.

However, non-diversifiable dangers are identified thru the research and estimation of the statistical relationships between the other asset portfolios of the company through other techniques, together with main components analysis. There is no specific way that can be used to maintain the non-diversifiable risk. This is due to their impact which is mirrored on the entire market.

Conclusion

Wrapping up, due to this fact, different possible choices are made through buyers relating to whether to comply with or not other funding choices relying on the risk kind focused on such investments. In case of a non-diversifiable risk, including inflation and wars, investors select to put money into portfolios, like real property, which contain lesser risk.Which one of the following is an example of unsystematic ...

Which one of the following is the best example of a ...

8 Amazing Training Outline Templates to Download for Free ...

Which one of the following is an example of diversifiable ...

Which one of the following is an example of unsystematic ...

You have a portfolio consisting of stock A and stock B The ...

Learn SEO: The Ultimate Guide For SEO Beginners [2020 ...

Learn SEO: The Ultimate Guide For SEO Beginners [2020 ...

Which one of the following is an example of unsystematic ...

Non-Ionizing Radiation - Definition, Examples and Quiz ...

Solved: Which One Of The Following Is An Example Of A Non ...

Which one of the following is the best example of ...

Chapter 13 Multiple Choice Finance ll BB.docx - Chapter 13 ...

exam 1.docx - Which one of these conditions must exist if ...

1 Which one of the following is the best example of ...

Solved: The Financial Break-even Point Determines Which On ...

You have a portfolio consisting of stock A and stock B The ...

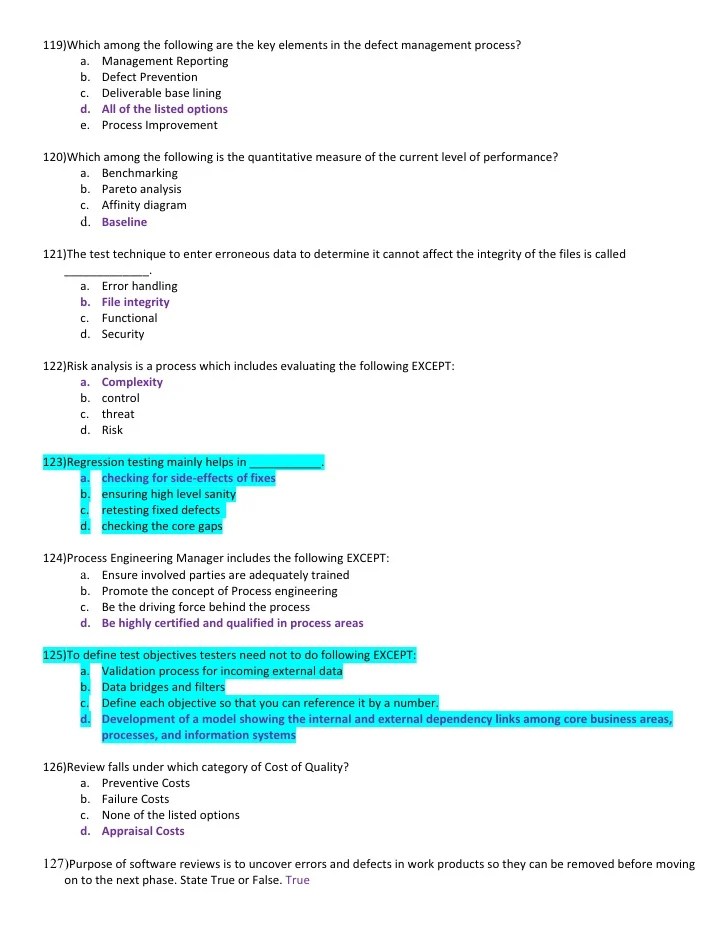

Software testing objective_types

Which one of the following is an example of unsystematic ...

Which one of the following is an example of diversifiable ...

Types of Sampling: Sampling Methods with Examples ...

0 Comment to "Nondiversifiable Risk Financial Definition Of Nondiversifiable Risk"

Post a Comment